Market Outlook After the Fed Meeting

https://www.youtube.com/embed/mQ4RAypXe-Y?si=KoX5mSEG3fz7uPjV ➖In this video, Anthony Crudele guides us on how to trade after a Federal Reserve (Fed) meeting, covering what to expect from FOMC decisions and how interest rate changes impact the markets. He explains how rate hikes or cuts affect various asset classes, market behavior, and key trading strategies for navigating the volatility that […]

When to Choose Micros vs. Minis

https://www.youtube.com/embed/OZ_Y0uP9eEk?si=msCHp7cK8yvL9mE4 ➖In today’s episode, Anthony and Tom will discuss the current market themes and how and when to choose which micros vs minis. ➖ Trade Futures for less! Keep your futures trading costs low through deep discount commissions & low margins. Open a NinjaTrader account to experience award-winning Futures services, and get access to the […]

Live Trading ES!

https://www.youtube.com/embed/Wg7JmSm7OEk?si=avTQkRufxk–37mO ➖ Join me for a hands-on trading session where I’ll take a look at the E-mini S&P 500 futures (MES=F), dissecting real-time price action and uncovering hidden opportunities within. I compare the indexes using apples to apples in my strategy, meaning I use the same exact strategy on a daily chart and look to […]

How to Choose Which Index to Trade

https://www.youtube.com/embed/tVQoI0i2Jf8?si=MQzD4O6-2V71XSVI ➖In today’s episode, Anthony and Tom will discuss the current market themes and how to choose which index to trade. We’ll cover essential topics like trading strategies and tips for navigating various trading indexes while Anthony shares his insights on determining which index suits your trading style and goals. ➖ Trade Futures for […]

Why I’m Bullish on ES and NQ Short-Term

https://www.youtube.com/watch?v=O5JnStQmPjY In my latest video, I break down why I’m bullish on NQ and ES short-term. Not fading these rallies. I rely on Bollinger Bands, AVWAP, Beacon Indicator, and a 5-day SMA for my tech analysis. This is a mean reversion back to the primary trend—the kind of move that packs serious power. 📈 ➖ […]

Market Outlook After the Fed Meeting

https://www.youtube.com/embed/BLDworqA3Gk?si=jFjk5b2oE1IJevQd ➖ Join us as Anthony discusses market outlook after the fed meeting and how to trade the start of the month. ➖ At 1/10 the size of one Bitcoin, Micro Bitcoin futures are a cost-effective way to manage risk and get exposure to the markets. https://www.cmegroup.com/markets/cryptocurrencies/micro-cryptocurrency-futures-and-options.html Want access to my Daily Pre-Market Plan and […]

Live Trading Bonds

https://www.youtube.com/embed/KmXBHUUFbNI?si=5z7LOcCStPKPOkMC ➖ Join us as Anthony guides us through a live trading session, providing insights and strategies for navigating the current market. Anthony will explore the specifics of bonds and on trading bonds in real-time. ➖ Now you can do more to manage short-term risk with the newly introduced WTI Crude Oil Weekly options […]

Live Trading the E-Mini S&P!

https://www.youtube.com/embed/JUylyQaCtwI?si=n6a3cajI-J1n0YNi ➖Join us as Anthony guides us through a live trading E-Mini S&P session, providing insights and strategies for navigating the E-Mini. https://www.cmegroup.com/insights/economic-research/2024/why-does-crude-oil-track-soybean-oil-diesel.html ➖ Want access to my Daily Pre-Market Plan and intraday analysis? 📈 Join my free Discord: https://discord.gg/sV3yJhmJdW

3 Technical Reasons ES Futures Will Hit 5450

https://www.youtube.com/embed/ZjBhs2Mzm2M?si=4ijSGAjusAJDm44R In this video, I delve into 3 Technicals Reasons Why ES Will Hit 5450. I’ll share my charts and break down three technical reasons that support my thesis that the market is headed into a short term mean reversion mode. As always, I’ll demonstrate how I utilize Bollinger Bands, VWAP, RSI, and a 5-day […]

Live Trading NQ!

https://www.youtube.com/embed/8KDOs6cl7zo?si=6ib-BrvX3zSK3860 ➖Join us as Anthony guides us through a live trading NQ session, providing insights and strategies for navigating the Nasdaq. https://www.cmegroup.com/markets/agriculture/grain-and-oilseed.html ➖ Want access to my Daily Pre-Market Plan and intraday analysis? 📈Join my free Discord: https://discord.gg/sV3yJhmJdW

What You Need to Know About Trading Rollover Week!

https://www.youtube.com/embed/yscadj81sYM?si=6fJkMSsMuWxp1c2B ➖ In today’s episode Anthony delves into the intricacies of trading, focusing on the crucial period of rollover week. He explains what rollover is, why it’s significant, and how traders can navigate this period effectively to optimize their strategies. ➖ https://www.cmegroup.com/activetrader/event-contracts.html ➖ Want access to my Daily Pre-Market Plan and intraday analysis? 📈 Join […]

Live Trading Treasuries!

https://www.youtube.com/embed/qnIyWUsdOmg?si=MglNBSPZT0qbxmsv ➖Join us as Anthony delves into the intricacies of trading, with a special focus on live trading strategies and the dynamic world of treasuries. We’ll explore how markets behave in real-time and uncover actionable insights for traders of all levels. ➖ The volume in Bitcoin Futures is continuing to spike. Optimize your exposure with […]

S&P 500 Futures: 5200 Level Next? ES1!!

https://www.youtube.com/watch?v=jOaq3WwSV7A In this video, I break down why the E-mini S&P Futures could be aiming for the 5200 mark soon. Utilizing Bollinger Bands, the 5-day SMA, VWAP, and RSI, I dissect the potential moves and patterns within the market. I also give insight on the E-mini Nasdaq NQ1!, and why day traders should be looking […]

Live Trading Crude Oil!

https://www.youtube.com/embed/HSASO-C8e1U?si=G6BsUnaGf8LZ75T5 ➖In today’s episode, Anthony Crudele goes through his strategy when live trading Crude Oil. We go into the intricacies of trading, focusing on sessions with crude oil. He shares insights on the latest market trends, strategies for trading stocks, and how to navigate the current stock market climate. Tune in to gain actionable tips […]

Micro Vs. E-Mini Futures | Which to Trade

https://www.youtube.com/watch?v=XaxCKmFdW2c ➖ In today’s episode, Anthony Crudele will discuss when to trade micros vs. E-Mini Futures. He goes into the nuances of micros and E-mini futures, comparing their features, advantages, and the best times to trade each. From understanding the basics of futures trading to deciding when to choose micros over E-minis.Tune in to gain […]

S&P 500 & Nasdaq Targets Next Week! All Time Highs Incoming?

https://www.youtube.com/watch?v=Ioi8UYnuN-Y In this video, we will discuss the potential targets for ES1!, NQ1!, and RTY1! in the upcoming week. The technical indicators I’ve used include Bollinger Bands (20,3), Beacon Indicator, 5-day SMA, and YTD AVWAP. The market environment has turned bullish again as I believe the short-term sell-off in market indexes is over. We are […]

How to Find a Good High or a Good Low!

https://www.youtube.com/watch?v=HsGfP-Cfs_s ➖ In today’s episode, Anthony Crudele will discuss how he finds what he considers to be a good high or a good low in trading. Anthony delves into the art of identifying optimal trading positions, mastering the technique of spotting highs and lows, and crafting effective trading strategies.Learn from an expert trader about the […]

How to Keep Your Losers Small!

https://www.youtube.com/watch?v=E4-ltkqsbks ➖ Anthony Crudele, a seasoned trader, shares insights on trading, risk management, and keeping your losers small. He dives into strategies for minimizing losses, the importance of risk management, and practical tips on trading effectively.Tune in to learn from Anthony’s expertise and discover how to navigate the trading world while safeguarding your investments. ➖Put […]

How to Day Trade Gold!

https://www.youtube.com/watch?v=IfyGI1mSVNw ➖ In today’s episode, Anthony Crudele will discuss his strategy for how to day trade gold. He goes into his experience with day trading, offering insights into the strategies and techniques involved specifically in day trading gold. From understanding the nuances of day trading to navigating the unique dynamics of the gold market, this […]

Trading $RTY vs. $ZN!

https://www.youtube.com/watch?v=cfezKe-hpCQ ➖ In today’s episode, Anthony Crudele will discuss trading $RTY versus $ZN.Anthony will delve into the intricacies of trading both the Russell 2000 Index ($RTY) and the 10-year Treasury Note ($ZN). He’ll explore the key differences and strategies for trading these two distinct markets, offering insights into how they can impact your trading portfolio. […]

Day Trading Agricultural Markets!

https://www.youtube.com/watch?v=KwIOKJxnKoo ➖ In today’s episode, Anthony Crudele will delve into the intricacies of day trading agricultural markets. He’ll cover the fundamentals of trading, focusing on the main agricultural products traded at CME and the strategies involved in trading these commodities effectively, including insights into ticks and market movements. Join us as we explore the exciting […]

Macro and Technical Outlook on Commodities

https://www.youtube.com/watch?v=Nj590i1u35c In today’s episode, Anthony Crudele and ChiGrl will discuss their perspectives on macro and technical outlooks on commodities. They delve into the intricate world of macroeconomic factors and technical analysis, providing insights into trading commodities, with a focus on natural gas. From understanding market macros to navigating technical indicators, this episode offers valuable perspectives […]

Live Trading Micro Bitcoin!

https://www.youtube.com/watch?v=AzxZ2CIA-Y0 Today we are live trading micro Bitcoin! Throughout the discussion, Anthony dives deep into various aspects of trading, strategies for trading micros, and the unique dynamics of micro bitcoin alongside traditional bitcoin trading. Tune in to gain valuable insights directly from an experienced trader and learn how to navigate the world of micro bitcoin […]

How to Trade Following a Fed Meeting!

https://www.youtube.com/watch?v=jdiWAWT9sq0 ➖ In today’s episode, Anthony will delve into yesterdays’ FOMC and the intricacies of how to trade following a fed meeting. Join us as we explore the dynamics of trading, the impact of Fed Meetings, dissect the FOMC’s decisions, uncover effective trading strategies, and analyze market movements in the wake of these crucial events. […]

Market Insights: How to Spot a Trend vs. Consolidation Day

https://www.youtube.com/watch?v=uqdkA1bb0Y4 Welcome to our latest video where we will be discussing the important topic of spotting trend days versus consolidation days in the stock market. Being able to identify whether the market is in a strong trending state or a period of consolidation can greatly impact your trading decisions and overall success in the market. […]

Making the Move from Forex to Currency Futures!

https://www.youtube.com/watch?v=iAhL4V5BSSA Anthony will guide us through the nuances of making the move from Forex trading currency futures, exploring key differences, advantages, and strategies for transitioning between the two. He’ll share insights on navigating this transition, shedding light on the opportunities and challenges it presents. Tune in now to gain a competitive edge in the ever-evolving […]

Trading the End of the Month: Why the Last Day Matters

https://www.youtube.com/watch?v=mCvRLL38dOU ➖ In today’s episode, Anthony discusses the significance of trading at the end of the month and why the last day matters. He emphasizes the importance of having a well-defined trading strategy tailored for month-end movements. Tune in to gain valuable insights that could enhance your trading approach! Micro E-Mini Equity Index Futures […]

Market Forecast: Why I’m Bullish $NQ

https://www.youtube.com/watch?v=Zj_9N5Olt4Q In today’s episode, Anthony will shares insights on his current market forecast, emphasizing why he’s particularly bullish $NQ and discusses his trading strategies within this context. ➖ Interested in getting 50% off brokerage fees for the lifetime of your account at TradeStation? Click here: https://www.tradestation.com/anthony

Natural Gas: What Are the Technicals Showing Us?

Sponsors: https://www.youtube.com/watch?v=aV59gNg4OXI ➖ In today’s episode, Anthony Crudele will discuss what the technicals are showing us when it comes to trading Natural Gas micros. Join us as Anthony live trades micros, focusing particularly on the nuances of trading natural gas and the importance of understanding technicals.Discover key insights into navigating the natural gas market and […]

Market Forecast: The Week Ahead in ES, NQ, RTY, and 10 YR

https://www.youtube.com/watch?v=hNc0PgRCHsU In today’s episode, Anthony will dissect the market forecast for the upcoming week, focusing on the week ahead in key indices such as ES, NQ, RTY, and 10 YR bonds.Join us as we delve into insightful analysis on market trends, what to anticipate in these indices, and deciphering essential charts to guide your trading […]

Homepage – Opt-in Thank You

Thank You For Signing up You will be redirected to homepage shortly.. Unleash Your Trading Potential Get my daily market analysis and master the key trading strategies that have led to my success as a 25+ year Futures trader. Join My Free Discord Anthony Crudele Former S&P Pit Trader, Founder of Place Your Trades, and […]

Newsletter – Thank You

Thank You! Expect to see more content from us in the near future Back To Home Page Start Every Morning with an Edge on the Markets Know Your Market Environment Range Expansion Mean Reversion Consolidation Get on the Right Side of the Trade Who’s in Control? Bulls vs. Bears Which markets are leading? Is there […]

About

About Anthony Anthony Crudele is a seasoned Futures trader with 25+ years of experience. His journey began in 1995 as a runner at Lyn Waldock, marking the initiation of his experience in the financial markets. From there, he took on various roles, eventually becoming one of the youngest members on the trading floor of the […]

Contact

Get in Touch Have any questions, comments or feedback? Write us a message and our team will get back to you shortly.

Edge

Sponsored by: Develop Your Edge Develop Your Edge delivers expert trading insights tailored for beginner and intermediate traders. Anthony simplifies complex concepts, guiding traders through the current markets using technical and fundamental analysis to find an edge. Latest Episode: More Episodes

Newsletter

Get Deli’s Daily Note Sent Straight to Your Inbox Kick off each trading day with a comprehensive pre-market overview featuring: an analysis of the current market environment, charts with key levels to watch, and a snapshot of the economic events calendar so you’re never caught off guard Start Every Morning with an Edge on the […]

Home

Unleash Your Trading Potential Get my daily market analysis and master the key trading strategies that have led to my success as a 25+ year Futures trader. Join My Free Discord Anthony Crudele Former S&P Pit Trader, Founder of Place Your Trades, and host of Futures Radio Show, Develop Your Edge and 10 Minute Technicals. […]

Live Trading Micro Treasuries!

https://www.youtube.com/watch?v=L3GO1qj3KQ4 In today’s episode, Anthony Crudele dives into live trading micro treasuries, offering expert insights on strategies, market analysis, and the nuances of micros and treasuries. Join us as we witness real-time trading action and gain insights into the dynamics of micro treasuries. Tune in for valuable tips and real-time trading action to enhance your […]

How to Trade the Weakness in $RTY!

https://www.youtube.com/watch?v=LpGy447EQYo In today’s episode, Anthony Crudele will delve into the intricacies of how to trade the weakness in $RTY, the Russell 2000 Index. Tune in as Anthony shares insights on trading strategies, live trading experiences, and navigating market weakness, specifically focusing on the $RTY. Gain valuable knowledge and actionable tips to enhance your trading skills. […]

Master Breakout Trading: How to Trade a Rally Without Chasing

https://www.youtube.com/watch?v=-h2XgMMPsn0 Join Anthony in this episode as we address the burning question on everyone’s mind: With the markets at all time highs, how can I master breakout trading and position in this breakout rally without chasing? Anthony explores how to trade a rally without chasing and gives insights on the importance of trading with […]

Range Expansion on $ES: Why I’m Bullish on the Breakout!

https://www.youtube.com/watch?v=naGng3y_RmY In this video, I’m breaking down exactly why I’m bullish on the breakout, talking range expansion on $ES and why I think that $ES is primed for a test of 5000. When analyzing the market environment, I always look for three key scenarios: range expansion, consolidation, or mean reversion. Currently, the ES is showing […]

What to Look for in a Short Setup in $NQ

https://www.youtube.com/watch?v=rabZKQiHJmw Join us in today’s episode as Anthony takes us through the intricacies of trading $NQ with a focus on exactly what he looks for in a short setup before executing a trade. Learn key aspects of trading setups, and explore the nuances of what to look for in a setup before going short. Whether […]

Weekly Market Outlook $ES $NQ $RTY

https://www.youtube.com/watch?v=OMayemsD2Ng In this video, I provide my weekly market outlook and analysis for the upcoming week (1/16-1/19) focusing on S&P 500, Nasdaq 100, and Russell 2000 Futures ($ES, $NQ, and $RTY). Understanding the market environment is crucial for both day traders and swing traders. I discuss how to ascertain if this week will be a […]

Mastering Confirmation Indicators in Trading

https://www.youtube.com/watch?v=aQUeHMFtEYA ➖ In today’s episode, Anthony explores mastering confirmation indicators in trading; focusing on distinguishing confirmation indicators from strategies. Gain practical insights into effectively utilizing these indicators for informed trading decisions. Whether you’re a seasoned trader or a beginner, this episode provides actionable tips to enhance your trading skills. Tune in to elevate your approach […]

Trading in 2024: How January Sets the Tone for the Markets

https://www.youtube.com/watch?v=Jcj6RrJ7s5E In today’s episode, Anthony dives into trading in 2024 with the topic of: How January Sets the Tone for the Markets. Kickstart your trading year with valuable insights as Anthony explains what the first trading day of the year tells us about initial market flows, and how he sets up his technical indicators to […]

How to Trade the Holiday Markets

https://www.youtube.com/watch?v=KJNGDDpFhX0 Anthony explores the unique dynamics of how to trade holiday markets and shares insights on end-of-year trading in the stock market. From navigating the festive season fluctuations to maximizing year-end gains, this episode provides practical tips and considerations for traders looking to make the most of holiday market opportunities. Tune in to gain a […]

Interest Rate Trading For Beginners!

https://www.youtube.com/watch?v=8Wl6B1SN39w In today’s episode, Anthony will discuss Interest Rate Trading For Beginners. Anthony breaks down the fundamentals of interest rates, interest rate trading, and provides valuable insights for those venturing into trading for the first time. Whether you’re a novice or looking to enhance your trading skills, this episode covers essential concepts related to interest […]

Daytrading Checklist: What to Look for Before Placing Trades

In today’s episode, Anthony will discuss his daytrading checklist and what to look for before placing trades. He will go over a comprehensive guide to essential factors for successful day trading. In this video, Anthony covers critical points for day traders, including the importance of assessing the big picture market environment, identifying market leaders, recognizing […]

Proven Strategies: When to Swing Trade vs. Day Trade

https://www.youtube.com/watch?v=3qGM0PFUzkI Today we are talking proven strategies regarding when to swing trade vs. day trade. We’ll dive into the essential factors that can help you make informed decisions in the world of trading, including understanding the market environment, recognizing divergence in indexes, and how to interpret the market’s reaction to key indicators. If you’re looking […]

Unlocking Trend Reversals: Mastering Bollinger Bands and VWAPs

https://www.youtube.com/watch?v=togJREm-bDI In this comprehensive video tutorial, we will unlock trend reversals and delve into the powerful techniques of utilizing and mastering Bollinger Bands and VWAPs (Volume Weighted Average Prices) to identify and master trend reversals in the futures market. ES1! You will learn how to leverage these volatility-based indicators to detect potential turning points in […]

Maximizing Profits: Knowing When to Trade Big with Full Position Size

https://www.youtube.com/watch?v=a0FhVaPt8Lw In this session, we discuss the importance of maximizing profits and when to trade big with full position size when the right setup presents itself. As I often say, there’s three ways to trade: big, small or not at all. I will elaborate on the necessity of implementing a systematic approach to identify top-tier […]

Trade Like a Pro: How to Pick Which Micro Futures Market to Trade

https://www.youtube.com/watch?v=mTxv-G2y_t0 In this informative session, we explore the realm of micro index futures trading, spotlighting popular indices such as ES, NQ, RTY, and YM. While many traders stick to one index, understanding the nuances of when to choose one over the other is essential for success. 📈 This year, the markets have been exceptionally dynamic, […]

Micro Energy Futures: Live Trading Strategies

https://www.youtube.com/watch?v=7oiExp5s188 Are you seeking access to oil and energy markets without hefty costs? Join me in this live trading session where I unveil the secrets of entering this market affordably through live trading energy micros. I will reveal my real-time strategies that have led to my success, empowering you to enhance your confidence and optimize […]

My Profile

Change your password

Mastering Micro Futures: Live Trading Strategies Revealed

https://www.youtube.com/watch?v=hjNSqr6Frpw Join Anthony Crudele as he live trades micro futures and shares his step-by-step analysis and practical tips for executing profitable trades. Witness the power of real-time strategies that can help you make informed decisions, boost your confidence, and optimize your trading results. Micro futures have revolutionized the trading landscape, providing a low-cost entry point […]

The Power of the Opening Range – Mastering Trading Strategies

https://www.youtube.com/watch?v=g4PCpGwla10 Welcome to our video on “Trading Using The Opening Range: The Power of the Opening Range – Mastering Trading Strategies.” In this informative session, we delve into the powerful concept of utilizing the opening range to enhance your trading strategies. Understanding the opening range is critical for successful trading, as it sets the […]

Trade Like a Pro: Master this Bollinger Bands Trading Strategy

https://www.youtube.com/watch?v=Ry-CcHVm7-4 📊 Tired of wrestling with market trends? Finding yourself caught in the crossfire of a two-way market battle? Making trades that feel like they’re timed to perfection, only to see the market reverse on you? If any of these scenarios sound familiar, you’re in for some valuable insights. Join me in this video as […]

4500 Incoming? Why I’m Long ES this Week

Get ready for a bullish surge! 🚀 The stars have aligned, signaling a rally to 4498 this week. Anchored VWAP, moving averages, and Beacon Indicator all in sync. Let me break it down for you: First, we have the Anchored VWAP, a powerful tool that tracks the volume-weighted average price. When combined with moving averages […]

10-Minute Technicals Copy

Anthony and Tom discuss why the CPI release is the most dangerous day to trade as of lately. Also how situational and self awareness are the best New Years resolution a trade can have. Understanding market forces pre-, during and post-trade is a critical key to becoming a better trader. Join NinjaTrader’s Tom Schneider, CMT […]

10-Minute Technicals

Anthony and Tom discuss why the CPI release is the most dangerous day to trade as of lately. Also how situational and self awareness are the best New Years resolution a trade can have. Understanding market forces pre-, during and post-trade is a critical key to becoming a better trader. Join NinjaTrader’s Tom Schneider, CMT […]

Trading from Zero: The Blueprint for Beginners | Learn VWAP, Cumulative Delta, and More

https://www.youtube.com/watch?v=0jgRgNSDK9w Imagine resetting the clock to the age of 18 in the year 2023, retaining all your hard-earned trading wisdom. Join me in this video as I guide you through rebuilding your trading venture from the ground up. Discover how I’d harness tools like VWAP, cumulative delta, and the 3-minute opening range to pave the […]

Why Your Win Rate Doesn’t Matter | What to Focus on Instead

https://www.youtube.com/watch?v=Xx7AObprPaY Is your win rate really the most important factor in your trading success? 🚫📈 In this video, I’m going to challenge everything you thought you knew about measuring the success of your trades. Most traders get hung up on increasing their win rate, but contrary to popular belief, it’s not a strong indicator of […]

Mastering the Art of Placing Stops & Dynamic Risk Management! | Trading for Beginners!

https://www.youtu.be/5ravMhns_xA In this video, we break down Risk Management in plain English! Dive into understanding what risks are and how we plan for them, spotting potential problems, and deciding the best ways to tackle them. Check out the Contract Directory and Calendar Tool here From basic strategies to advanced techniques and understanding risks in different […]

How I’m Analyzing NQ & What To Look For Nasdaq Trading!

Learn more about NYMEX Crude Oil Weekly Options here In this video, we discuss specific day trading strategies for the Nasdaq 100 (NQ). We focus on a possible short position if the market opens below 15,748, which could lead to a test of the 15,368 level. However, this strategy is only valid if the market […]

WHY Do Commodities Trade Differently | Futures Trading!

Click here

Boxing In VOL $CL (Bollinger Bands) Oil Futures Trading

https://youtu.be/GMHkuXdSeso Learn about Micro WTI Crude Oil We explore an effective method for measuring volatility and interpreting market sentiment using Bollinger Bands. By leveraging these indicators, we can construct execution boxes to guide our trading decisions. Our focus for this episode will be on analyzing oil futures, providing valuable insights into market sentiment. Tune in […]

Scalp VS Swing | Which Is Better & In Which Conditions? Part 2

https://youtu.be/LEPOMjWC1ic Click Here to Join the FX Trading Challenge today! In this episode, we delve into two popular trading styles: scalp trading and swing trading. Scalp trading is a fast-paced approach that focuses on short-term price movements, involving quick trades, tight stop-loss levels, and rapid decision-making. We examine its effectiveness in volatile markets and during […]

Scalp VS Swing | Which Is Better & In Which Conditions? PT1

https://www.youtu.be/p5IsawU2RjM? Join the CME’s Groups FX Trading Challenge today! Join Here Get Today’s Chart Deck HERE Scalp trading and swing trading. Scalp trading is a fast-paced approach that focuses on short-term price movements, involving quick trades, tight stop-loss levels, and rapid decision-making. We examine its effectiveness in volatile markets and during specific news events. On […]

How Traders Made Millions Every 4 Months! | Trading Strategy | Futures 📈

https://youtu.be/ExPs3MTfYTg In this episode, we’ll discuss the intriguing strategy of spread trading between current and upcoming futures contracts – a strategy that has paved the way to millions for some traders. We’ll explore how these traders bet on the slow and steady closure of the spread, helping them gain a significant edge in the market. […]

Real Risk Management w/ Range of Execution

https://youtu.be/KicgBqHPUAs In this insightful video, we’ll go into practical strategies that traders can implement to effectively manage risks in the volatile world of trading. Learn how to assess risk levels, set appropriate stop-loss orders, and develop a comprehensive risk management plan that aligns with your trading goals. Don’t miss this opportunity to enhance your trading […]

Gold Technical Analysis: Why I Think It’s Time To Short

https://youtu.be/xZbSOafFL50 I explored Gold’s Technical Analysis and discussed why it might be a good time to short. I broke down recent market trends and key indicators to support my viewpoint. You’ll gain a unique perspective on gold trading strategies that could potentially enhance your investment decisions. So you can’t miss this video. Open a new […]

Show

Show

Trading Has Evolved: Here’s How You Can Take Advantage

https://youtu.be/s4dkLQwVG_A Trading has evolved, and today we’re discussing how things have changed over the years and what hasn’t changed at all. We’ll also talk about using a different approach as the market conditions change. Stay ahead of the game and maximize profits with these techniques. Open a new NinjaTrader Brokerage account to get the Order Flow + […]

Analyzing Environment Conditions To Win More/ Lose Less

https://youtu.be/l5HkutF0G-0 We explored the various environmental factors that can impact trading success, including market volatility, economic news releases, geopolitical events, indicators and more. We also discussed how to assess these conditions, how to adjust your trading strategy accordingly, and how to minimize risk during periods of uncertainty. Open a new NinjaTrader Brokerage account to get […]

123

Trading Order flow VWAP with Standard Deviation Bands 📊

https://youtu.be/cVDrL73DbcU Volume weighted average price is one of the best technical analysis tools out there, but no one really talks about how S.D. Bands can really add a different dimension to this famous indicator. They’re specially good for riding trend days and taking profits at the right places and also spotting reversals at key areas […]

Forgot password?

Back forgot password? No worries, we’ll send you reset instructions. Email * reset password

Forgot Password – Success

Thank You For Registering!

Thank you for for signing up, an email with your login details is on it’s way! Go To Login Page

Registration

Back sign up Create an account to start. You will get access to: Mini-Course with Strategy Breakdown Trading eBook packed with knowledge Chart decks from Futures Radios Show episodes Automatically registered for giveaways Email * Submit or Already have an account? Log in

Pre-login

Loading…

Login

Back log in Please log in to your account. Forgot password? or Don’t have an account? sign up

Terms of Service

Privacy Policy AnthonyCrudele.com is serious about protecting your online privacy. This Privacy Statement explains our views and practices concerning privacy, and how they may pertain to you as a user of our website. “You” or “Your” means you as a participant in or as a user of the AnthonyCrudele.com website. “We” or “Our” or “Us” […]

Privacy Policy

Privacy Policy AnthonyCrudele.com is serious about protecting your online privacy. This Privacy Statement explains our views and practices concerning privacy, and how they may pertain to you as a user of our website. “You” or “Your” means you as a participant in or as a user of the AnthonyCrudele.com website. “We” or “Our” or “Us” […]

These Current Market Conditions Forced Me Stop Trading

https://youtu.be/UheSzPBjBbw I’ve had really good trading days as of lately, but the current market environment is forcing me out of the game for sometime. We’re stuck in a very volatile range where nobody seems to be winning because it doesn’t fully range or trend, making it extremely hard to pick a side and make money. […]

Using Cumulative Delta | Trading Strategy Confirmation📈

https://youtu.be/gDHS1covQp4 Using a confirmation indicator for a trade can really be useful sometimes. In other situations you can have steep opportunity costs by keeping you out of entering valid trades. Well, in today’s episode of Develop Your Edge, we will cover everything you need to know about my favorite confirmation indicator, cumulative delta. Things like […]

Trading Futures

Trading Futures Anthony’s Trading Futures Series consists of 18 video interviews with top futures traders discussing their trading process along with health/wellness experts sharing information to traders on how to live a healthy lifestyle beyond the charts.

How to Identify Trend Days & Trade Them Successfully 💡

https://youtu.be/wFl-HoHzaMc Have you ever wondered how some traders can identify a trend day before it happens? In this week’s episode of Develop Your Edge, we’ll show you the signs to look for that could indicate an upcoming trend day. We’ll cover everything from cumulative delta, to VWAP, Bollinger bands and more, so you really can’t […]

How Pit Traders Used to Execute on Support & Resistance

https://youtu.be/5Tq168duKGc In this episode of Develop Your Edge: I took a trip down memory lane and shared my experiences as a pit trader. I discussed how we used to trade support and resistance back in the day and the important lessons that traders can learn from these methods. Whether you’re a seasoned trader or just starting out, this […]

10-Minute Technicals

Sponsored by: 10-Minute Technicals 10 Minute Technicals offers a quick and insightful overview of the latest market trends. In each episode, Anthony utilizes technical analysis to dissect the current market environment, providing viewers with concise anda actionable insights in just 10 minutes. Latest Episode: More Episodes

Home old

Get a mini course, ebooks, chart decks, giveaways, and more SUBSCRIBE NOW Anthony crudele – 25+ year Futures Trader, one of the youngest members in CME Group history. Host of Futures Radio Show. Twitter Instagram Youtube DEVELOP YOUR EDGE A weekly YouTube show where host, Anthony Crudele and his guests report newson Financial Markets and […]

Preventing These Bad Habits = Successful Trading Career

https://youtu.be/6A3mDOgBQds There’s a couple well known “facts” about trading: for example that only the top 5-10% of traders ever make money and even fewer keep that money and grow it. That’s why I’m going to tell you the top things that could ruin your trading career, so you can evade them in the future and […]

How I Built My First Successful Strategy | Becoming PRO

https://youtu.be/SIzQjJTVRd8 Let me tell you the story of how I first developed my own edge in the markets, this event helped me minimize my weaknesses and enhanced my biggest strengths. To the point were I was able to have 6-figure days with this simple strategy. This strategy was based on bollinger bands and fibonacci retracement […]

4 Things Pro Traders DON’T DO: From Intermediate to Pro

https://youtu.be/vyvjeesw1GI On this weeks show we talk about a pattern I’ve noticed throughout the years in consistently profitable traders that I consider “pro”. There’s these 4 things they all have in common in how they execute their strategy and process the right way. It’s (“How they handle drawdowns”, “what’s their mind frame after a loser”, […]

Sometimes Trading Can Be Brutally Difficult; Here’s Why

https://youtu.be/4zoCE1ApNw4 On this week’s show, I tell the story of how I made and lost 6-figures, all within two months of trading back in 2009. What happened to me was horrific at the time, but it taught me some things about real discipline during good & bad times. I’ll be sharing those tips with you […]

Trading with a Range of Execution for Better R/R Ratios

https://www.youtu.be/ao0vmLqfK4w?feature=share In today’s show: We talk about how to use a range of execution when trading for risk to reward ratios. How to use it in different environments like a bear market, a bull market, or a sideways market, and when not to trade them! Open a new NinjaTrader Brokerage account to get the Order […]

How to Trade the RSI: A Simple Guide

The day after a FED meeting can get a bit crazy. But on this episode of Develop Your Edge, Anthony goes deep into how to use the RSI to interpret environment on days like this and mix it up with Bollinger Bands and Order Flow VWAP to create a complete view of the market and […]

TRADE S&P FUTURES LIKE A PRO – Order Flow VWAP Strategy

n this video, I’m going to show you how I use NINJATRADER’s Order Flow VWAP trading indicator to make money in the S&P futures markets. Order Flow VWAP trading is a powerful strategy that can help you make money trading futures markets. This strategy is easy to use and can be applied to most other […]

Holding on to Winners: 3 Simple Rules for Maximizing Profits in Trading

I’ve talked a lot about the macro and technical environments on a longer-term chart or longer-term time and how it affects our abilities to do the right thing when we trader. There is no exact formula to this, but I have some simple rules that anyone can follow, three things that could help them get […]

First CPI release of the year – Here’s How To Trade It

Anthony and Tom discuss why the CPI release is the most dangerous day to trade as of lately. Also how situational and self awareness are the best New Years resolution a trade can have. Understanding market forces pre-, during and post-trade is a critical key to becoming a better trader. Join NinjaTrader’s Tom Schneider, CMT […]

Can You Safely Trade FED Rate Decisions & CPI Numbers?

On this episode of Develop Your Edge we talk about how I like to trade FOMC Wednesday’s and CPI number release. A lot of retail traders love to trade these news releases, but not everyone knows how to trade them. It can be so violent and volatile that you can be ultimately right and still […]

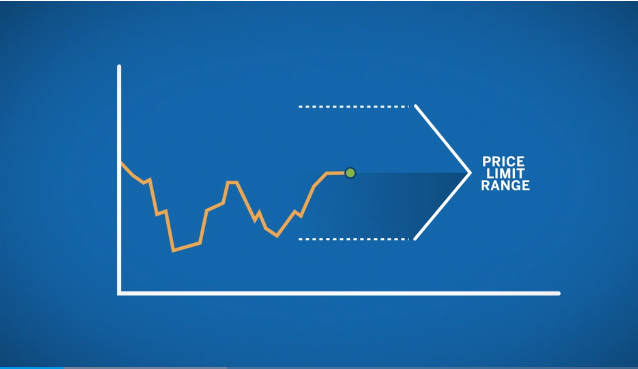

Tip For Trading During Rollover (Fortunes Made & Lost)

The start of rollover is the only time of the year that I absolutely don’t trade. This time of the year strategies tend to not work at all, or very little. It’s all about the market participants having to do something instead of wanting to do it. So it’s imperative that you’re careful and adjust […]

Trading The 1st Day Of The Month

In this weeks DYE Anthony discusses why the 1st Trading of the month can be a tricky day for futures trades. He goes over how he trades when the environment is unclear, why the S&P is in a very important area right now, and he answers a question from the audience about position sizing when […]

Using Bollinger Bands to Identify Trend Reversals

https://youtu.be/Vi94hFLT0hk Anthony Crudele and Tom Schneider discuss how to use Bollinger Bands to determine change in trends. – Learn insights into the markets– See actionable, real-time trading examples– Discover the benefits of adding futures to your trading arsenal If you’re reading this you have to subscribe!! If you’re already a part of the community, share the […]

What You Need to Know About Futures Trading and Risk Management

https://youtu.be/ENOl5aIPJBQ Anthony Crudele and Tom Schneider discuss how risk management for Trading Futures is not just about protecting the downside, it’s also about capitalizing on the upside. – Learn insights into the markets– See actionable, real-time trading examples– Discover the benefits of adding futures to your trading arsenal If you’re reading this you have to […]

Trading Instincts For Futures Trading

https://youtu.be/Nel1_e8cDoM Anthony Crudele and Tom Schneider discuss how to recognize and mitigate trading instincts. – Learn insights into the markets– See actionable, real-time trading examples– Discover the benefits of adding futures to your trading arsenal If you’re reading this you have to subscribe!! If you’re already a part of the community, share the link with a […]

How to Profit in Sideways or Choppy Markets

https://youtu.be/McK8I08zIMg So many traders, when we get into a sideways market environment, look for too much, and they are too active. This type of strategy keeps me very patient and I have multiple confirmations: -over bought -three standard deviation -sideways on the day trading chart -sideways on the longer term daily chart This has been […]

Strategy For Trading EUR/USD

https://youtu.be/G1xoDWFWTCc Anthony Crudele and NinjaTrader’s Tom Schneider examine factors that go into determining which index future is ideal for market trends, when, and why.Expand your market opportunities and discover the multitude of ways futures can enhance your trading strategies. Join us and futures trading market pro Anthony Crudele each week as we dive into the […]

Day Trading Strategy with VWAP Standard Deviation Lines and RSI

https://youtu.be/yenWJ-44HuE How do we use the standard deviation lines along with the RSI for a day trading strategy? In this week’s DYE we’ll be using these 2 indicators for our day trading strategy. We’ll go over three different types of days (sideways trend day, trend up day, and a trend down day) and we’ll be […]

Choosing The Right Index

https://youtu.be/_v93txNLyNQ Anthony Crudele and NinjaTrader’s Tom Schneider examine factors that go into determining which index future is ideal for market trends, when, and why. Expand your market opportunities and discover the multitude of ways futures can enhance your trading strategies. Join us and futures trading market pro Anthony Crudele each week as we dive into […]

How To Recognize Market Bottoms

https://youtu.be/edB-bs7fa4c How to recognize when the market bottoms? There is no way to ever tell if a market’s top or a market’s bottom. We never know until way later, but today I’m going to show you my process for identifying market bottoms. On this week’s DYE we pulled up a weekly E-mini S&P chart, and […]

A Simple Day Trading Strategy To Trade A Bear Market

https://youtu.be/Qkt7dARb5UY A simple day trading strategy to trade a bear market. In this episode, we use a simple day trading strategy that can be applied for any market that’s in a bear market. We use these 3 indicators for this strategy:Order Flow VWAPRSIOrder Flow Cumulative Delta Open a new NinjaTrader Brokerage account in June and […]

How To Choose The Best Indicators For Your Strategy

https://youtu.be/L_w71Fgz4uU How To Choose The Best Indicators For Your Strategy? Expand your market opportunities and discover the multitude of ways futures can enhance your trading strategies. Join us and futures trading market pro Anthony Crudele each week as we dive into the Benefits of Futures. – Learn insights into the markets– See actionable, real-time trading […]

How to Identify Reversals Using Bollinger Bands & Fibonacci Retracement

https://youtu.be/5FHrvwmKFis How to Identify Reversals Using Bollinger Bands & Fibonacci Retracement? In this Develop Your Edge episode, we’ll use these two indicators – Bollinger Bands and Fibonacci Retracements to identify trend reversals, stalled and consolidated trends & continuing trends. Open a new NinjaTrader Brokerage account in June and SAVE $100 on a NinjaTrader lifetime license. […]

A Simple but Effective Way to Use RSI for Day Trading

https://youtu.be/L18w9t73DO0 Relative Strength Index (RSI) is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions and the price of a stock, future, or crypto. How to effectively use the RSI for day trading? In this week’s #developyouredge episode, I’ll share an effective way […]

NASDAQ Futures vs QQQ

https://youtu.be/Kfq8LalaEmw Expand your market opportunities and discover the multitude of ways futures can enhance your trading strategies. Join us and futures trading market pro Anthony Crudele each week as we dive into the Benefits of Futures. To watch these LIVE, check out our schedule here! – Learn insights into the markets– See actionable, real-time trading […]

How To Use Order Flow VWAP To Determine Market Direction

https://youtu.be/jh6wczdFqvY How to use Order Flow VWAP to determine market direction? How to identify a RANGE-BOUND day? I use a three-minute chart and I anchor that Order Flow VWAP to the first three-minute bar during the regular trading hours. Anytime that I see that VWAP spent a majority of the time in that opening three-minute […]

Using Futures To Hedge Your ETH & NFT’s

https://youtu.be/thQ4llXvZFs Expand your market opportunities and discover the multitude of ways futures can enhance your trading strategies. Join us and futures trading market pro Anthony Crudele each week as we dive into the Benefits of Futures. – Learn insights into the markets– See actionable, real-time trading examples– Discover benefits of adding futures to your trading […]

How To Use Moving Averages

https://youtu.be/64GXWsYhrjI There are tons of ways to use moving averages. In this #developyouredge episode, I’ll share how to determine which type of moving average to use and how to use them in our trading strategies. There are two types of moving averages: SMA (Simple Moving Average) is a calculation that takes the arithmetic mean of […]

Our Execution Is More Important Than Our Trading Strategy

https://youtu.be/UxDZeQjzSeA Every strategy works sometimes. No strategy works all the time. In this week’s #developeyouredge, we look at Ethereum, explained why I’ve been getting long ETH, and talked about why the execution of our strategy is what determines our success, not our trading strategy itself. Right now, I see ETH is working, holding off a […]

Importance of Identifying If We Are In A Two-Way Market

https://youtu.be/caw-4lph3NY It’s not always about identifying whether our market is in a bull market or a bear market. It could be about identifying if we’re in a two-way market. In this week’s #developyouredge episode, I’ll share why I believe we’re in two-way trade and why it’s important to identify if we’re in this kind of […]

How To Identify Trends With 200 Day Moving Average

https://youtu.be/Tky4r7n5wSU The 200 Day Moving Average is one of the most popular technical indicators that traders and investors use to identify trends. In this week’s #NinjaTrader Charting Edge, I’ll take you through a series of examples where the 200 Day Moving Average is used to identify trends. Is there a possibility of history repeating itself? […]

My Favorite Strategy For Determining Exits

https://youtu.be/D_hBG47CdW0 What is your favorite strategy for looking for exits? Why trading is so much about being in rhythm? On the previous episode, a trader asked me: WHAT IS YOUR FAVORITE STRATEGY FOR LOOKING FOR EXITS? In this week’s episode, we look at the E-mini S&P 500 chart and apply my strategy on how to […]

E-mini S&P 500 ESG Futures

https://youtu.be/yLWd_-nsq9A E-mini S&P 500 ESG Futures Contract SpecsPRODUCT CODE : ESGCONTRACT SIZE $500 x S&P 500 ESG Index.MINIMUM PRICE FLUCTUATION Outright: 0.02 Index points, equal to $10.00 per contract.Calendar spread: 0.01 Index points, equal to $5.00 per calendar spread.BTIC: 0.01 Index Points, equal to $5.00 per contractESG contracts at cme group are cash settled. Sustainable […]

Your Strategy Is Only A Tool

https://youtu.be/Uf9uZZkxwJE Your strategy is only a tool. Let the market be your guide. In this week’s #developyouredge episode, we talk about how I’m trading Crude Oil – why I’m only trading it to the long side. Also, we talk about how I use the “Your strategy is only a tool. Let the market be your […]

Why Keep A Trading Journal

https://youtu.be/0PlFRkcbXFQ What are some of the Key Benefits of Having a Trading Journal? 📙Keep a daily trading journal to keep track of the details of your trading experience. It helps put a focus on post-trade analysis. 📒Use a pen and paper. Your brain processes information differently this way, improving understanding and memory retention. 📙Keep track […]

Support And Resistance Levels Don’t Matter

https://youtu.be/7HZFFwqhxmY It’s not your support and resistance levels that matter. It’s the reaction to your support and resistance levels that matter. In this week’s #developyouredge episode, we look at Gold – which is I believe currently on a 2-way trade. Also, we talk more about why Support And Resistance Levels Don’t Matter and It’s The […]

Understanding Margins For Futures Trading

https://youtu.be/t-cfpGTrkRM Understanding Futures Margins • Day trading margins or intra-day margins provide futures traders with leveraged buying power.• Real time intra-day margining can result in a more efficient use of capital over similar cash or over the counter markets.• As an example traders for a SPY ETF would need to trade hundreds of shares to […]

Why Focus On Only One Side Of The Market

https://youtu.be/o8uqgFCLpV8 Why day traders should only be focusing on one side of the market? In this week’s #developyouredge episode, we look at Bitcoin & Crude Oil – we talk about how the opening ranges for the year are extremely important and discuss how I believe day traders should really be focusing on one side of […]

Basis Trade at Index Close (BTIC) Bitcoin Futures

https://youtu.be/j6FPPA3ZqI4 Basis Trade at Index Close (BTIC) allows market participants to trade futures at a fixed spread to the reference price of a known benchmark index. How does BTIC work?BTIC orders and transactions have their own unique tickers, providing market participants price discovery and transparency on the spread, or difference, between the price of the […]

What Is The Most Traded Futures Contract In The World – Eurodollar Futures

https://youtu.be/cDE24zNBuDs What is the most Traded Futures Contract in the World? Eurodollar Futures As the fundamental building block of the financial market, Eurodollar futures and options are the preferred tool of traders to express views on future interest rate moves. With unrivaled book depth and deep liquidity out more than five years, you can effectively […]

4 Most Common Pitfalls For Traders

https://youtu.be/Rctw1B_zWuI What are the four most common pitfalls for traders? 1️⃣Fear of missing out or FOMO. Stick to your trading plan. Don’t chase the market. There’ll always be another opportunity later in the day or the next day. 2️⃣Overleveraged. Maxing out in your daytrade margins could result in poor profit target and stop-loss placement. Take […]

Trading With The Trend

https://youtu.be/KIhtoEqzMgI Why you’re far better off going with the trend late in the trend cycle than fading a trend early? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! In this week’s #developyouredge […]

Find An Edge Within Yourself

https://youtu.be/XgSq6CoVWbk WHAT SEPARATES YOU FROM THE FIELD? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! It’s not just about finding an edge in the market. It’s about finding an edge within yourself. […]

Best Way To Analyze Your Trades

https://youtu.be/KPCQDYrvrs8 What is the best way for traders to analyze their trades? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! In this week’s #NinjaTraderChartingEdge, we look at Nasdaq’s Micro (MNQ) and E-Mini […]

What Is Market Profile

https://youtu.be/ecDycFQeIy0 What is the Market Profile? The Market Profile is a unique charting tool that enables traders to observe the two-way auction process that drives all market movement—the ebb and flow of price over time — in a way that reveals patterns in herd behavior. Put another way, the Profile is simply a constantly developing […]

Keys To Trading Volatile Markets

https://youtu.be/GRG6O15xQlA In this week’s episode, I’ll share some of the keys that I look for when trading volatile markets. Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! Everyone can tell you right […]

Learning To Trade Is Not The Same As Learning To Be A Trader

https://youtu.be/2f7shg8DgnA There’s a big difference between learning how to trade and learning how to become a trader. Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! There’s a big difference between learning how […]

Micro Treasury Yield Futures

https://youtu.be/0WJXb0ZEDDI What is a US Treasury benchmark rate? The current yields on the most recently auctioned treasury securities at certain locations along the treasury yield curve. Micro Treasury Yield futures will reference the benchmark yield for the 2-Year Note, 5-Year Notes, 10-Year Note, and 30-year US Treasury Bond. Trade Futures for Less! Keep your futures […]

When To Trade Aggressive

https://youtu.be/qVHJu4th-x0 When to be aggressive in trading futures? How do you recognize that? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! Like I laid out: it’s mentally, financially, and statistically, all of […]

COT Financial Futures Report

https://youtu.be/IJ0LeujwScQ What is the Commitment of Traders (COT) Financial Futures Report? Trade Futures for Less! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! The Commitment of Traders (COT) Financial Futures Report separates large traders in […]

The Right Way To Add To Losing Trades

https://youtu.be/pGVX4NOm7i4 Why do most traders get it wrong when it comes to adding to losers? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! In this week’s NinjaTrader Charting Edge we pull the […]

How To Choose Your Technical Indicators

https://youtu.be/Gwa5zbL8LM4 How do you go about choosing your technical indicators? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! I have three simple rules… 1️⃣ Know your timeframe 2️⃣ Know your style […]

7 Lessons From Highly Successful Traders

https://youtu.be/RJMPYmeM4Kg Is it necessary for us traders to follow other successful traders and watch what they’re doing in order for us to find our edge in trading? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to […]

Most Efficient Trade Journal Process

https://youtu.be/MLn-dCRdWR0 What’s the better method and system for note-taking that makes it an effective way in time and practice to review our trading? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! I […]

4 Macro Trading Edges

https://youtu.be/Fdj4FvLBXBo Welcome to this special DYE episode where we go back and play clips of what I think are 4 must watch moments from 4 of my favorite Macro Traders! Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal […]

Where Do Most Traders Go Wrong?

WHY DO MOST TRADERS FAIL? All of us have expectations when we go into trading but if we set our expectations too high and we don’t meet them, that makes us feel like we failed. Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning […]

Why Great Technical Analysis Alone Is Not Enough

https://youtu.be/WUtiPi4dIMQ Why traders with the best technical analysis skills are not the best traders? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! On this week’s Ninja Trader Charting Edge, we have the […]

Forget Price Targets, Focus On The Trend

Traders should spend more time studying where trends or environments may change than looking for targets. Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! In this week’s Ninja Trader’s charting edge, we […]

Overcome Your Hidden Bias

https://youtu.be/Fp9dWLvXfAY Don’t let your hidden bias dictate the way you look at the charts. Look at the charts with an open mind and make sure the market proves to you what it wants to do. Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning […]

What Is Contango & Backwardation?

https://youtu.be/hbFrwPxUXNE What is Contango and backwardation? Contango and Backwardation are terms used to define the structure of the forward curve. When a market is in contango, the forward price of a futures contract is higher than the spot price. Conversely, when a market is in backwardation, the forward price of the futures contract is l […]

4 Keys To Developing Your Trading Edge

Welcome to this special DYE episode were we go back and play clips of what I think are 4 must watch moments from previous DYE videos. Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check […]

Understanding Futures Spreads & Why They Are So Popular

Spreading, a trade in which you simultaneously buy one futures contract and sell another, is a popular strategy among many different asset classes. One reason they are popular is because they can be less risky when compared to outright futures. And because they are less risky, they also tend to have lower margin requirements. Trade […]

Henry Hub Natural Gas Futures

What are Henry Hub Natural Futures? Trade Futures for Less!! Keep your futures trading costs low through deep discount commissions & low margins. Experience NinjaTrader’s award-winning futures brokerage services and personal support. Click here to check out NinjaTrader! The best way to trade Natural Gas is using CME Groups NYMEX Henry Hub Natural Gas Futures, […]

Long Term Charts To Become a Better Short Term Trader

https://youtu.be/I1CW0yG2GU4 To become better short term day trader you have to get better looking at the bigger picture charts. Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! In this week’s Ninja Trader’s charting edge, we have the E-mini S&P 500 for the 4th week in a row with the same old, same old […]

How To Trade Aggressively, Cautiously Or Not At All…

https://youtu.be/6L3kevbS-0o We’re going to discuss 3 different scenarios, green light that means full speed ahead, trade aggressively. Yellow, wanna be a little bit more cautious about what I’m seeing in the markets and red, which means you shouldn’t trade at all. Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! On this week’s Ninja […]

Your Trading Plan Shouldn’t Be Set In Stone

https://youtu.be/cYmSJO4WaDs A good trading plan is not set in stone, a good trading plan allows a trader to adapt & change course if the markets conditions change! Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! On this week’s NinjaTrader Charting Edge, we touch on the E-mini S&P 500 on whether I think it’s […]

No Two Trades Are The Same

Any successful trader knows that managing risk is not just about minimizing risk, it’s also about knowing when to take on more risk. In my experience successful trading is about seizing moments & some moments require taking on more risk than others. Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! On this week’s […]

Bulls Win, Bears Win, But Pigs Get Slaughtered

Don’t focus on finding tops or bottoms, focus on determining the environment. On this week’s Ninja Trader we touch on Ethereum and why I’m bullish right now, and what I’m looking for to re-enter those long positions. Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! Then we’ll go over a tweet and our […]

4 Great Discussions With 4 Technical Analysis Masterminds

https://youtu.be/QR2YygTVia0 Welcome to this special DYE episode were we go back and play clips of what I think are 4 must watch moments from previous DYE videos. Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! Merritt Black tell us the story of how he got his mental edge and what it took to […]

What Is The Best Way To Trade Interest Rates?

What is the best way to trade interest rates? Futures Markets. In futures markets, the US government borrows money primarily by issuing bonds and notes or fixed terms. 2 years, five years, ten years, and 30 years. US Treasury bonds trade around the clock leading to constant price fluctuations. Trade Futures for Less!! Keep your […]

Futures vs ETF’s – What’s The Difference?

Futures vs ETF’s – What’s The Difference? Futures out trade ETF’s by 12x. Futures are more capital efficient offer potential tax benefits, and around the clock trading to speculate & manage risk. While equities are closed, pure exposure to the underlier and no management fees. Trade Futures for Less!! Keep your futures trading costs low […]

4 Great Discussions With 4 Great Traders

https://youtu.be/DAvxtWPLDT0 Welcome to this special DYE episode were we go back and play clips of what I think are 4 must watch moments from previous DYE videos. Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! Linda Raschke tells us about her mathematical and mental edge when trading the markets Mike Bellafiore speaks about […]

How To Trade Your Plan & Recognize When It Needs To Change

https://youtu.be/mZ4NC9bmVNE The main difference between a good trader and a bad one is their ability to execute their trading plan & adapt to changes in the environment. Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! On this week’s NinjaTrader charting edge we touch on Gold, my targets and what I think of the […]

Don’t Fight The Market, Just Flow With It!

Focusing on what you think the market should be doing, is a fool’s errand. Accepting and flowing with what the market is telling you, is what consistent winners do. Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! On this week’s NinjaTrader Charting Edge we touch on Gold, my targets and what I think […]

Your Stop Loss Is Way More Important Than Your Take Profit

Determining where you’re wrong is much more important than knowing your price target. That’s something the best technicians understand and implement in their trading journeys. Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! On this week’s Ninja Trader we touch on Ethereum and why I’m bullish right now, but more importantly at what […]

Market Relationship & Experience

You need a relationship and experience with a market to successfully trade it. Imagine a pro basketball player playing hockey against a pro hockey player… It won’t work out well, will it? Trade micro-futures commission for less!!!! Click here to check out NinjaTrader! In this week’s Ninja Trader, we look at Gold, what I think about […]

5 Things You Need For A Trading Edge

You can’t impose your will on the market! Unless you want to unnecessarily lose your trades. In this week’s Ninja Trader Charting Edge, I’ll show you what everybody’s asking about… What I think about the S&P 500 with E-mini futures. Then I’ll present to you the 5 things that will help you to find & […]

Currency Futures vs Spot Forex

Why trade futures over Forex? First off, transparent and level playing field. Since there’s no centralized exchange in forex trading, there is limited market transparency. Although forex is an electronic market, orders are often dealing desk, with a middle man in place processing the forex orders. There are inherent challenges ensuring a fair call for […]

Don’t Agree With Me

I don’t need or want people to agree with me and my thinking about trading or the markets. I want people to challenge my thinking. As a trader I don’t need validation in my ideas, I want to be challenged in my thinking so I can get better. I discuss why this type of thinking […]

Micro Crude Oil Futures

Ticker Symbol MCL, Micro WTI Crude Oil futures are 1/10 the size of the standard-sized contract -providing market participants an efficient and cost-effective way to gain exposure to the crude oil market. Trade micro-futures commission free with & an award-winning trading platform. Click here to check out NinjaTrader! The standard Crude Oil contract has a notional […]

Trading is a Journey of Oneself

Trading is a journey of oneself. This has been at the top of my twitter page for years and I wanted to address how embracing this type of thinking is extremely important in a traders career. Each and every year our trading is a journey of emotions, a journey of executing setups in different environments […]

Micro Bitcoin Futures

https://youtu.be/xzy9MkY7Qck At 1/10 the size of one bitcoin, Micro Bitcoin futures (MBT) provide an efficient, cost-effective new way to fine-tune bitcoin exposure and enhance your trading strategies. Enjoy the features of Bitcoin futures (BTC) in a smaller size that enables traders of all sizes to manage bitcoin price risk. Trade micro-futures commission free with & […]

Dealing With Stagnant Periods In Your Trading

Sometimes we lose ourselves in the weeds and we lose our rhythm. To get that rhythm back, I get flat and lean on my favorite setup just to get that rhythm and flow of execution back. In this video I go over my recent struggles executing trades in ETHUSD and how I had to put […]

Environment Dictates Activity

Our job as traders is not to trade everyday, but to trade everyday when the environment suits our style and strategy. Last week with Tom Canfield we talked a lot about environment and how Tom and I take money from the market in moments. I got a lot of questions about that and one question […]

Be Dumb, Follow Price

https://youtu.be/f2ORsr4CAto Many say that your edge should be able to be explained in a sentence or two, but is that really possible? For some it may be, but for traders like myself and Tom Canfield it isn’t that easy. We’re discretionary traders that believe our edge is constantly evolving. Not sure I know anyone on […]

A Traders Most Important Edge

We all work so hard on technicals and statistical or mental edge, but I believe the most important edge for a trader is recognizing when our edge is present in the market and executing it in that moment. It doesn’t matter how great of an edge we have, it comes down to maximizing how much […]

Using Targets vs Trailing Stops

Should you use targets or trailing stops to get you out of your positions? In my trading I use a combination of both, but I don’t choose one or the other on the fly, I let the market environment dictate that. In this video I explain how I determine whether to use targets or trailing […]

Trading Around A Core Position

One of the keys for me in trading is to trade around a core position. Trading around a core position means that I keep a small position and then I trade around that small position. If I am long, then I will buy dips and sell rallies all throughout that time I keep a small […]

Seizing Moments In Markets

https://youtu.be/pfGL6WVsCZM Edges in our strategies come and go, that’s why it’s important to recognize when your strategy is working well and take advantage of it. Too many traders think that once they find an edge that it will last forever. I wish that was the case, but unfortunately it doesn’t work that way. We have […]

Micro Bitcoin Futures

Contract Specifications CONTRACT SIZE 0.10 bitcoin TRADING HOURS CME Globex: Sunday – Friday 6:00 p.m. – 5:00 p.m. ET (5:00 p.m. – 4:00 p.m. CT) with a 60-minute break each day beginning at 5:00 p.m. ET (4:00 p.m. CT) CME ClearPort: 6:00 p.m. Sunday to 6:45 p.m. Friday ET (5:00 p.m. – 5:45 p.m. CT) with […]

How I Prepare For Trading

https://youtu.be/MePbeGxQE0g Everyone talks about being patient, being disciplined, wait for your setups, but if you don’t prepare properly you can’t do any of those things correctly. One of the most important part of my edge as a trader is my preparation. Preparation goes beyond the charts for me…it’s about being prepared mentally, physically and technically. […]

How To Hold Onto Winning Trades

Why is holding onto winners so hard? I believe it’s because we spend most of our time searching for good entries and not enough time working on our process for exiting trades. In this latest Develop Your Edge I chat about how I use the philosophy of indicators in and indicators out, I go over […]

Pressing Winners

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! One of the things I’ve worked the hardest on in my career is doing more of what is working and less of what is not. It’s amazing how once we get into a trade that’s not working we […]

Dealing With Pressure

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Traders are competitors. We want to win, but the pressure we put on ourselves to win can hurt our passion…this is something I think we all go through as traders. We put a ton of pressure on ourselves […]

Identifying The Trading Environment

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Will today be a trend day? A range day? Potentially a choppy day? Everyday we as traders look at the charts and try to determine what kind of a trading day it may be and although there is […]

Scaling Into Trades

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Most traders are early getting into a position because we feel the need to be in a position or fear we will miss the trade. Scaling has helped me tremendously with this. Let price come to you and […]

Intangibles In Day Trading

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! You don’t always need to be able to put your finger on something to say it’s an edge in trading. I felt for years that I just needed a strategy that would give me high probability trading signals […]

Three Basics For Developing An Edge In Trading

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! When it comes to developing an edge in trade you must start with the basics. Most of us over analyze and complicate trading and end up overlooking the basics. In this video I go over three basic fundamentals […]

Thinking Outside The Box In Day Trading

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Developing an Edge for a day trader does not mean you have to come up with something proprietary, or be a quant, you just need to think outside the box. I took basic indicators, modified some settings, combined […]

Market Auction Theory

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Developing an Edge for a day trader is not something that happens overnight, it takes time and for most of us it isn’t one single thing that’s our edge, it’s a combination of things.. In order to be […]

Ease Of Short Selling In Futures

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Is it easier to short futures than short stocks? Yes, it is easier to short futures than it is to short stocks. In this video I chatted with Director of Sales at NinjaTrader, Walter Sledz about the Ease […]

Tax Advantages For Trading Futures

Do Futures Traders get Tax Advantages that Stock Traders don’t? Yes, they do. In this video I chatted with Director of Education at CME Group, Dave Lerman about the Tax Advantages & Efficiencies Futures Traders get. Trade micro-futures for less with & an award-winning trading platform. Click here to check out NinjaTrader! Futures trading offers […]

Trading Squeezes

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Everyone is talking about trading “squeezes” in the market lately so in this video I chatted with my good friend Anthony Drager, Founder of EdgeTrading Group who uses squeezes as his edge in day trading futures. Ant worked […]

Edge Trading Energy Futures

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Crude Oil & Natural Gas Futures are very popular markets for new traders to trade, but they are markets that are packed with professional traders looking well beyond the technicals on the charts for their Edge in those […]

Consistency & Willingness To Be Wrong Quickly

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Market Technician at Adaptiv, Ian McMillan joins me in this episode to discuss his edge in trading stocks. Ian is one of my favorite Market Technicians because he has a simple, but effective Edge in his Trading and […]

Benefits Of Trading Gold Futures

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! What is the best product to use to trade Gold Futures? For me it’s Gold Futures. In this video I chatted with Director of Metals Products at CME Group, Tommy hart about the Benefits of Trading Gold Futures. […]

Direct Exposure To Commodities Through Futures

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Commodity Futures can be a great tool for investors to get direct exposure to Commodities. In this video I chatted with the President of Gramza Capital Management, Inc., Dan Gramza on how Commodity Futures are the best tool […]

Trade With Profile

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Are you using or thought of using Market Profile in your Trading? If so, you’re going to love this video with Josh Schuler of TradeWithProfile. Josh is a very successful Profile Trader and in this show he explains […]

Using Micros For A More Precise Hedge On A Portfolio

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Micro Futures can be a great tool for investors to get a more precise hedge on their portfolio. In this video I chatted with the Director of Education at CME Group, Dave Lerman about using Micros to hedge […]

Pattern Day Trader Rule Doesn’t Apply To Futures

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! As an equity trader, have you ever been locked out of trading due to a day trading violation? Or have you missed an opportunity due to short selling restrictions? Well in Futures Trading, the Pattern Day Trader Rule […]

Always Be A Student

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! Just because we are day traders doesn’t mean we need to trade every day. Much of my time is spent watching the market and taking notes on things I’m seeing that can potentially help me on my next […]

Explaining Cash & Physical Settlements In Futures

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! In this video I spoke with the Team Lead of Trading Operations at NinjaTrader, Mike Scinto about defining what Rollover is in Futures Markets. Expiration All futures contracts have a specified date on which they expire. Prior to […]

Position Sizing

Click on our Sponsors logo’s to learn about special offers for Traders and important Futures Industry updates! What’s up Traders! Position Sizing is key in Trading. For years I struggled with the thought that if I traded the same size contract for every trade that I was being consistent and would find consistency in my […]

Learning To Lose In Order To Win